Hobart

Why Hobart?

waterfront, Mount Wellington backdrop, and emerging economic diversity. It supports a growing economy with strengths in tourism, public administration, education, healthcare, and creative industries. Major waterfront redevelopment and media-tech precinct initiatives are shaping Hobart’s future urban appeal.

Investment Highlight:

Median house price: A$897,000 in Q4 2024, softening by 5.0% year-on-year

Median unit price: A$530,500 in Q4 2024, down 21.6% year-on-year

Rental yields: House yields around 3.4%; local LGA yields around 4.0%

Rental market: Median rent at A$580 per week for houses; rental supply is limited

Vacancy rate: 0.9%, indicating tight market conditions

Sales activity: House sales increased by approximately 41%, unit sales rose by 4% in Q4 2024

New developments: About A$1.1 billion in projects commencing in 2025, including major waterfront and railyard redevelopments

Approximate Cost:

Median house price: A$897,000

Median unit price: A$530,500

Rental yields: ~3.4% for houses, ~4% for local LGA

Median weekly rent: A$580 (houses)

Vacancy rate: 0.9%

Market speed: Houses take about 45 days to sell

Ideal For: Hobart is ideal for investors seeking medium-term capital growth paired with stable rental demand in a lifestyle-rich capital city. It appeals to downsizers and young families attracted to waterfront living, city amenities, and an evolving creative-tourism hub. Developers and commercial operators will benefit from the city’s major precinct renewals, while professionals in tourism, arts, healthcare, and education will find Hobart a compelling regional centre with expanding opportunity.

Available Services

Testimonial

See what our happy clients say about their home-buying journey with us.

Location

Explore our real estate services in Your City today.

Melbourne

Sydney

Perth

Brisbane

Rockhampton

Bendigo

Adelaide

Frankston

Mildura

Townsville

Mackay

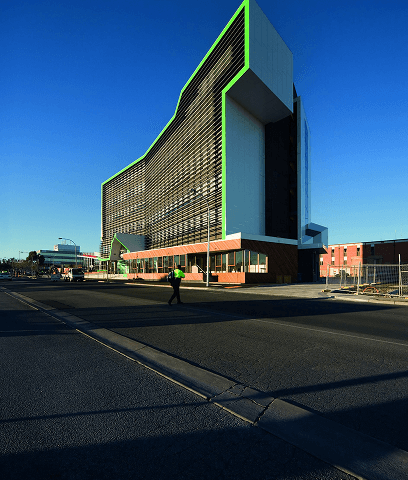

Latrobe City

Bunbury

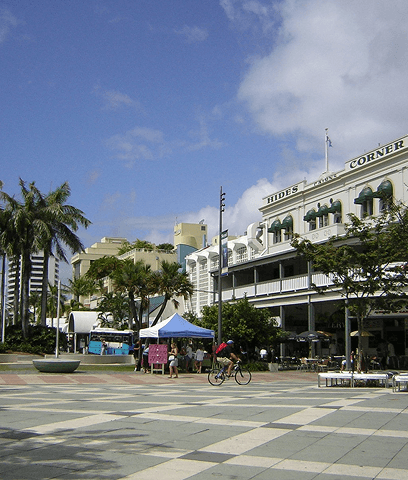

Cairns

Mandurah

Wagga Wagga

Brimbank City

Whittlesea

Humecity

Gladstone

Geelong

Shepparton

Rural City of Ararat

Devonport

Moreton Bay

Ballarat

City of Ipswich

Logan City

Hobart

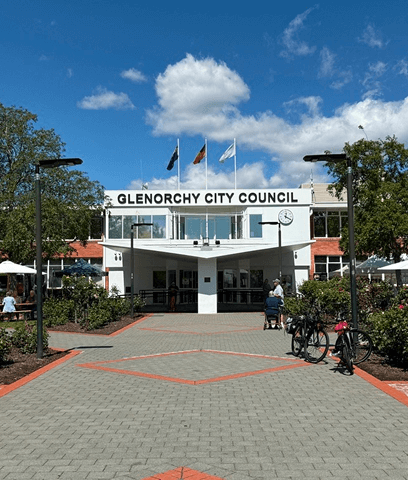

City of Glenorchy

Toowoomba

Wyndham

Albury

Casey

Point Cook

Cranbourne

Tarneit

Truganina

South Yarra

Craigieburn

Launceston

Ringwood

Tamworth

Armidale

Griffith

Maitland

Narrandera

Leeton