Gladstone

Why Gladstone?

Gladstone is a major industrial and port city on Queensland’s central coast, serving as the nation’s fourth-largest coal-export terminal and home to key heavy industries like alumina refining, LNG processing, and cement production. Its deep-water port supports substantial export activity, and the region continues to expand its industrial base with renewable energy initiatives and cruise tourism.

Investment Highlight:

Median house price: A$520,000 as of March 2025, representing a 23.8% increase over the previous 12 months. Houses often sell within 12 days.

Median unit price: Approximately A$350,000 to A$355,000, with 20%+ annual growth and typical unit rental yields around 6.3%.

Rental market strength: Vacancy rate stands at just 1.5%. Median house rent is about A$532 per week, with unit rent around A$431 per week.

Economic drivers: Powered by the Port of Gladstone—handling over 70 Mt of freight annually—and major industries including LNG, alumina, aluminum smelting, cement, and renewables. The city is also emerging as a green hydrogen hub, with Fortescue Future Industries leading large-scale developments.

Rapid demand: Gladstone ranked #1 in home value growth across regional Queensland, with property values rising 26.9% annually.

Approximate Cost:

Median house price: A$520,000 (March 2025)

Median unit price: A$350,000–A$355,000

Median rent: Houses A$532/week; units A$431/week

Rental yields: ~5% for houses, ~6%+ for units

Vacancy rate: 1.5% — indicating strong rental demand

Ideal For: Gladstone is ideal for investors seeking strong capital growth tied to industrial expansion, coastal living, and rental stability. The market suits investors targeting high-yield units and affordable homes, as well as first-home buyers seeking value outside larger metro areas. It also appeals to businesses and property professionals focused on workforce housing, logistical infrastructure, and renewable energy projects.

Testimonial

See what our happy clients say about their home-buying journey with us.

Location

Explore our real estate services in Your City today.

Melbourne

Sydney

Perth

Brisbane

Rockhampton

Bendigo

Adelaide

Frankston

Mildura

Townsville

Mackay

Latrobe City

Bunbury

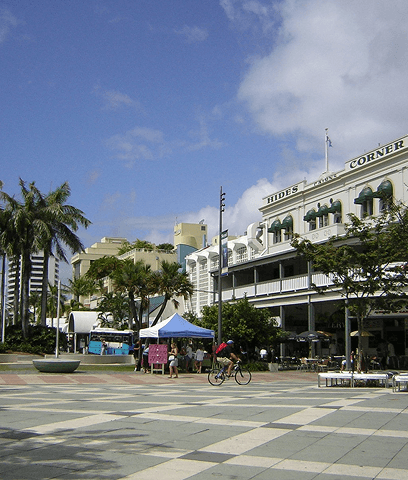

Cairns

Mandurah

Wagga Wagga

Brimbank City

Whittlesea

Humecity

Gladstone

Geelong

Shepparton

Rural City of Ararat

Devonport

Moreton Bay

Ballarat

City of Ipswich

Logan City

Hobart

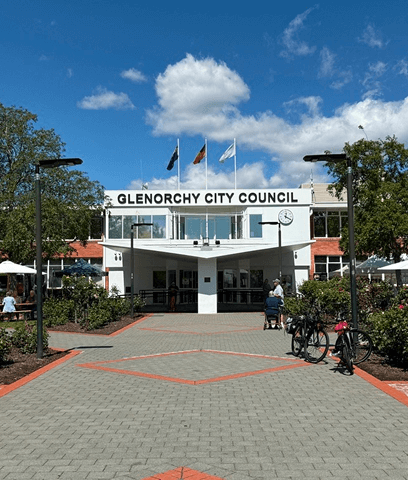

City of Glenorchy

Toowoomba

Wyndham

Albury

Casey

Point Cook

Cranbourne

Tarneit

Truganina

South Yarra

Craigieburn

Launceston

Ringwood

Tamworth

Armidale

Griffith

Maitland

Narrandera

Leeton